The Chapter 7 Vs Chapter 13 Bankruptcy Diaries

Table of ContentsLittle Known Facts About Chapter 7 Bankruptcy Attorney Tulsa.Little Known Facts About Tulsa Ok Bankruptcy Specialist.The smart Trick of Chapter 7 Vs Chapter 13 Bankruptcy That Nobody is DiscussingIndicators on Affordable Bankruptcy Lawyer Tulsa You Should KnowExcitement About Bankruptcy Attorney Near Me Tulsa

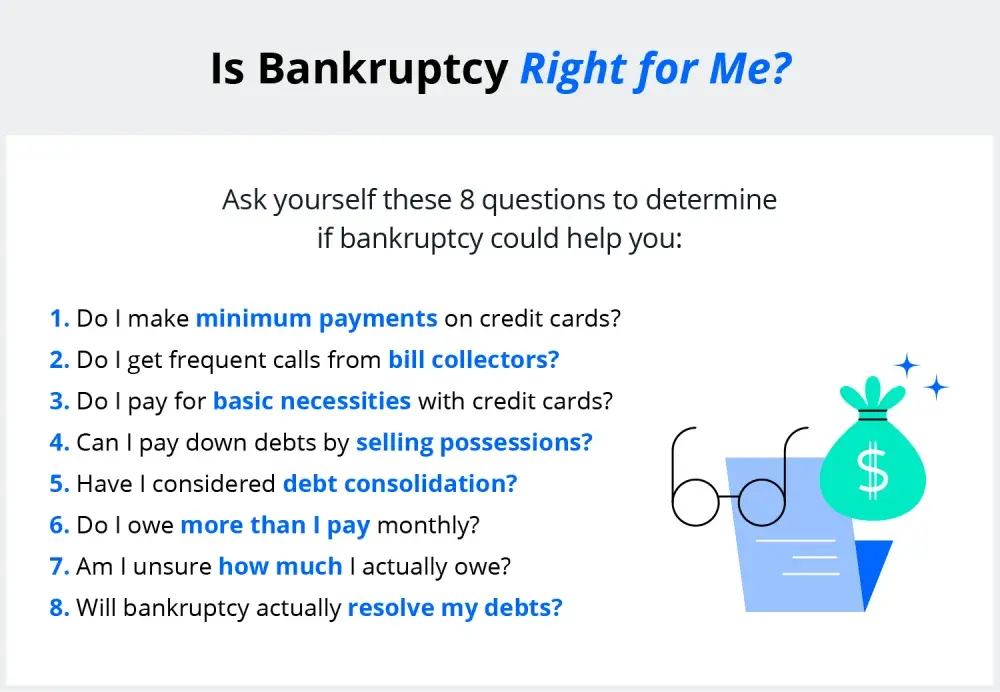

The statistics for the various other main kind, Chapter 13, are even worse for pro se filers. (We damage down the differences in between both key ins deepness listed below.) Suffice it to say, talk to a lawyer or 2 near you that's experienced with personal bankruptcy regulation. Right here are a few resources to locate them: It's understandable that you could be hesitant to spend for a lawyer when you're already under substantial economic pressure.Lots of attorneys likewise provide free appointments or email Q&A s. Take advantage of that. Ask them if personal bankruptcy is without a doubt the ideal choice for your scenario and whether they assume you'll qualify.

Ads by Cash. We may be made up if you click this advertisement. Advertisement Now that you have actually made a decision insolvency is indeed the appropriate strategy and you ideally cleared it with a lawyer you'll need to begin on the documents. Before you dive right into all the main personal bankruptcy kinds, you ought to obtain your own files in order.

Getting My Bankruptcy Law Firm Tulsa Ok To Work

Later down the line, you'll really need to confirm that by divulging all sorts of information about your economic affairs. Here's a basic list of what you'll require when traveling in advance: Recognizing papers like your motorist's license and Social Safety and security card Tax obligation returns (as much as the past 4 years) Proof of earnings (pay stubs, W-2s, independent incomes, income from possessions as well as any type of earnings from federal government benefits) Financial institution statements and/or pension statements Evidence of value of your possessions, such as vehicle and property appraisal.

You'll desire to recognize what kind of debt you're trying to fix.

You'll desire to recognize what kind of debt you're trying to fix.If your income is too expensive, you have an additional choice: Phase 13. This option takes longer to settle your debts because it requires a long-lasting settlement plan generally three to five years prior to several of your continuing to be debts are wiped away. The filing procedure is additionally a great deal more complex than Chapter 7.

The Single Strategy To Use For Tulsa Ok Bankruptcy Specialist

A Chapter 7 insolvency remains on your debt report for one decade, whereas a Phase 13 personal bankruptcy falls off after 7. Both have enduring influences on your credit rating, and any brand-new financial debt you get will likely come with higher rate of interest. Before you submit your insolvency types, you have to first finish a necessary program from a credit rating therapy company that has been accepted by the Division of Justice (with the noteworthy exception of filers in Alabama or North Carolina).

The program can be finished online, in person or over the phone. bankruptcy lawyer Tulsa Programs usually set you back between $15 and $50. You have to finish the training course within 180 days of declare bankruptcy (Tulsa bankruptcy lawyer). Utilize the Department of Justice's internet site to locate a program. If you reside in Alabama or North Carolina, you should pick and finish a program from a list of independently accepted service providers in your state.

Best Bankruptcy Attorney Tulsa Fundamentals Explained

A lawyer will typically manage this for you. If you're filing by yourself, recognize that there have to do with 90 different insolvency areas. Examine that you're filing with the proper one based upon where you live. If your permanent Get the facts home has actually relocated within 180 days of filling, you ought to submit in the area where you lived the higher portion of that 180-day duration.

You will need to supply a timely listing of what qualifies as an exception. Exceptions may relate to non-luxury, key vehicles; essential home products; and home equity (though these exceptions rules can differ extensively by state). Any kind of residential property outside the listing of exemptions is thought about nonexempt, and if you don't give any type of list, after that all your home is taken into consideration nonexempt, i.e.

You will need to supply a timely listing of what qualifies as an exception. Exceptions may relate to non-luxury, key vehicles; essential home products; and home equity (though these exceptions rules can differ extensively by state). Any kind of residential property outside the listing of exemptions is thought about nonexempt, and if you don't give any type of list, after that all your home is taken into consideration nonexempt, i.e.The trustee wouldn't sell your sporting activities automobile to quickly pay off the creditor. Instead, you would pay your creditors that amount throughout your settlement plan. A typical misconception with bankruptcy is that when you file, you can quit paying your debts. While personal bankruptcy can assist you erase a number of your unsecured debts, such as overdue medical costs or individual finances, you'll want to maintain paying your regular monthly settlements for safe financial obligations if you intend to keep the residential property.

Some Known Questions About Tulsa Bankruptcy Lawyer.

If you're at danger of repossession and have actually exhausted all various other financial-relief alternatives, then declaring Chapter 13 may postpone the repossession and assist in saving your home. Eventually, you will certainly still require the revenue to proceed making future home mortgage repayments, in addition to repaying any type of late payments throughout your layaway plan.

The audit could delay any type of financial debt alleviation by numerous weeks. That you made it this much in the procedure is a decent indication at the very least some of your financial obligations are eligible for discharge.

Comments on “The smart Trick of Chapter 13 Bankruptcy Lawyer Tulsa That Nobody is Discussing”